As the Serious Play Conference continues in Pittsburgh, there have been a couple of new reports out about the projected growth of and investment in the learning games market that are worth noting.

Both of the reports come out of the research firm Ambient Insight and offer a glimpse of what is going on in learning games.

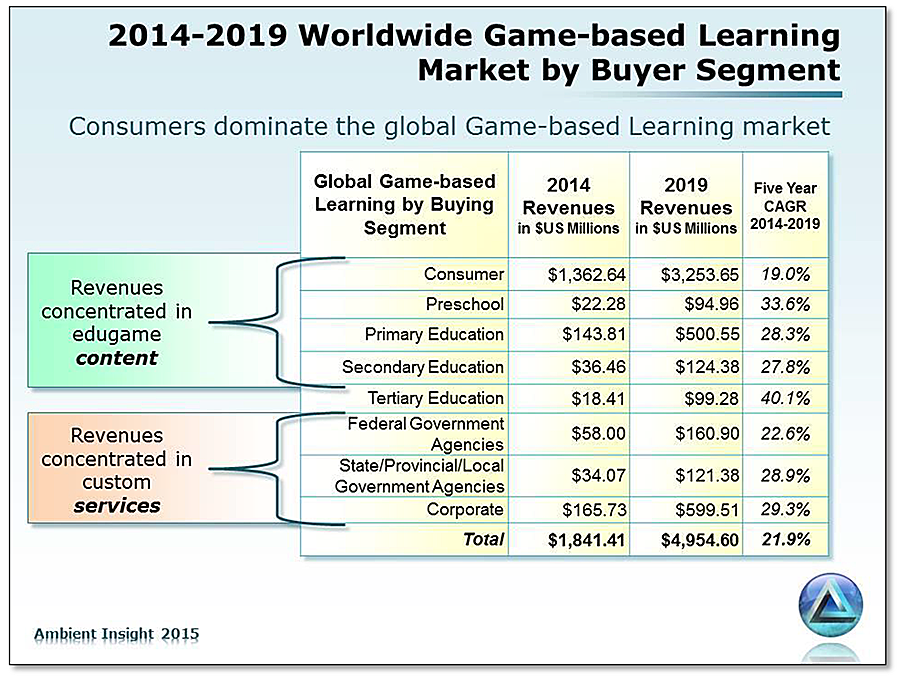

One report found that in 2014 worldwide revenues for digital edugames reached $1.8 billion. Ambient Insight focuses on predictive models for growth and in the same report they project a continued growth rate of 21.9 percent and see revenues reaching $4.9 billion by 2019.

“We now track learning technology in 119 countries and in most countries of the world revenues are heavily concentrated in the consumer segment primarily in three edugame types: early childhood learning, language learning games, and brain trainers,” Sam Adkins, Ambient’s chief researcher, said in a release. “Brain trainers consistently rank in the top twenty bestselling mobile edugames in 97 of the 119 countries we analyze.”

But even as the market expands, Ambient notes that the growth is not happening at the same pace everywhere. For example, North America is expected to see a growth rate of 14.9 percent, which sounds good until you compare it to China and Asia. China already is the largest edugame buyer and Ambient projects growth in that entire region to be more than 21 percent. That means by 2019, North American learning game revenues would be a little more than $920 million, but in Asia the revenues should top $2.9 billion.

Ambient’s reports have often focused on the consumer side of the market, which remains much larger (currently around 74 percent of the spending) and, as we will see in a minute, is drawing more investment, but this year the company took a deeper dive into the formal education buyers and what is happening in that market.

These are Ambient’s worldwide projections on buying based on specific sectors.

The market report comes in the same month that the firm released its report on the amount of investment flowing into a broader category of learning technologies, which include games, mobile learning, self-paced elearning tools and other products.

One of the key insights from the Ambient report is the strong investment in the consumer side of the market, which has outpaced money flowing into corporate-focused products and formal education.

Ambient reported in the first half of 2015, more than $1.4 billion went to consumer-facing companies, as opposed to the $537.2 million that went to B2B firms and $358.2 million that flowed to PreK-12-facing companies.

It is now abundantly clear that there is strong demand for digital learning products in the consumer segments across the planet and consumers are now avid buyers of digital education and training content. Online language learning is the top selling learning product type in every consumer segment across the globe.

— Ambient Insight’s 2015 International Learning Technology Investment Patterns

This projected increase comes as two other separate surveys offered glimpses into the technology landscape game-makers face for selling consumer- and school-focused learning games.

On the parents’ side, new report indicates they are likely to spend more money on technology around education this summer than they have in recent years.

The survey of 1,000 parents conducted by the Rubicon Project found that due to the stronger economy this summer, nearly two in five parents (38 percent) intend to purchase technology products such as laptops, tablets and mobile phones specifically to meet students’ in-class needs and requirements.

Rubicon is an ad company specializing in mobile and digital ads, so part of this is a pitch to companies to buy ads over the summer, but the numbers are still interesting as parents of kids in K-12 plan to spend on average $873 per student on all back-to-school stuff including tech and parents of college students are planning to spend more than $1,100 per student.

On the school side, IT-giant CDW-G has compiled a list of what connectivity really looks like in schools. Thanks to the government’s E-Rate program, 99 percent of America’s schools and libraries have an Internet connection, which sounds like good news for developers wanting to deploy web-based and mobile games in the classroom.

On the school side, IT-giant CDW-G has compiled a list of what connectivity really looks like in schools. Thanks to the government’s E-Rate program, 99 percent of America’s schools and libraries have an Internet connection, which sounds like good news for developers wanting to deploy web-based and mobile games in the classroom.

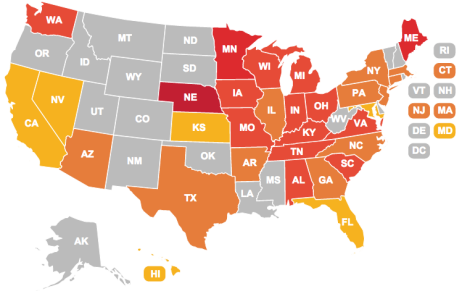

But CDW-G has been looking at whether the schools, once connected, have the actual bandwidth they need to run the programs they want and there the answer gets more complicated. The company has surveyed 400 schools and districts and put together a heatmap of how different states are faring when it comes to classroom-level connectivity.

It shows real uneven adoption of Internet into the classroom, with no clear regional rationale on why some states can boast 95 percent connectivity (Nebraska) and others trail far behind at as low as 54 percent (Florida). One thing this indicates is many schools, while being connected to the Internet or having Wi-Fi somewhere in the school are still lacking infrastructure that reaches the individual classroom.