This may be the year of the sheep according to the Chinese calendar but for investors it would seem 2015 turned out to be the year of the edtech.

Language training and elearning platform Hujiang raised a stunning $257 million in two rounds in 2015.

According to new research from Ambient Insight, 44 Chinese firms raked in $1.7 billion in new investment in the first 11 months of 2015. The outpouring of investment capital came despite a series of economic body blows during the year, including a stock market crash and widespread fears over its slowing economic growth.

“So far, the adverse economic conditions in China have not had a significant impact on edtech investment activities. In fact, investors are now describing the economic situation in China as an environment conducive to investment,” said Sam S. Adkins, Chief Research Officer at Ambient Insight.

But even more striking than the growth of the China market has been the size of the investment deals during 2015. Ambient Insight has tracked the investment deals and found that 21 firms had received investments of $50 million or more.

These deals, plus hundreds of other smaller ones, helped the global investment in educational technology soar past $5 billion for the first time in history and this is with a full month to go in the year.

“Not only is the investment total of $5.3 billion breathtaking but the massive volume of deal flow is striking. By November 2015, 589 companies on the planet were funded; this is 82% higher than all of the deals made in the entire year of 2014,” Adkins said in a statement.

The news prompted us to ask Adkins about the changing global nature of edtech and what kinds of companies and products are attracting all this money.

The China Syndrome

gamesandlearning.org: Your new report highlights the large tech investments flowing into China. Obviously China is a huge market, but is there a reason it is exploding in the tech space so quickly compared to the U.S., Brazil and others?

Sam Adkins: China is a fascinating market. On the surface, it appears that the economic conditions are quite similar to Brazil, but investment is booming in China and declining in Brazil. The similarities between the economies are more apparent than real. Very few individuals are invested in the stock market in China (the figure is cited as 9-11%) and stock market activity has little impact on the broader economy. There is no recession in China, although growth has “slowed” to 6.9% in the third quarter – a growth rate we would love to have. Likewise, the Chinese government has always manipulated the value of the yuan and the value has always been at the whim of the government. They devalued the yuan to boost exports.

The situation is way more complicated in Brazil. The inflation rate is very high and the dramatic devaluation of the Brazilian Real is economy-driven – a primary factor relating to the recession. Unemployment is at a five-year high. Brazil reported today that they are in three quarters of contraction, the longest since 1999. A headline today about the Brazilian economy said “Brazil’s economy is breaking down badly.” Investors are keeping their powder dry until they see a bottom in the currency valuation. For example, the German media conglomerate Bertelsmann and a domestic investment firm called Bozano are sitting on an edtech fund of roughly $100 million since last summer and have yet to invest in any Brazilian firm. Bertelsmann did directly buy a 40% stake in Affero Lab for $55 million in June 2015, which, to date, is an anomaly in Brazil. The second-highest amount in 2015 went to Movile’s Playkids education app division at $15 million, so you can see the disparity in funding.

The U.S. is fine so far. I am surprised by this to some extent considering that the U.S. eLearning market is now negative at -2.7%, the first time it has entered negative territory in the history of the industry. Yet, very large investments have been made to a few U.S. learning technology companies in the last year including the breathtaking $230 million that HotChalk obtained from Bertelsmann, Varsity Tutors at $50 million, $65 million to Udemy, $105 million to Udacity, and $186 million that went to Lynda.com (which was recently acquired by LinkedIn, so the investment was orchestrated for the buyout.) HotChalk is one of the major “Managed Services” suppliers serving he higher education market with turnkey online learning programs sometimes called “School-as-a Service”. Managed Services is one of the only bright spots in the U.S. eLearning industry with all the major players (Pearson, Wiley, etc.) reporting increased enrollment/revenue.

Who’s Making It Rain?

gamesandlearning.org: You’ve tracked in other reports the size of the market broken down by different sectors — consumer, B2B, K-12, pre-K, etc. Do you have a sense how these investments break down along those lines?

Sam Adkins: Yes, we sort the investments by target buyer segment and map product types to buyers. Just under half of the total investments made so far in 2015 went to consumer-facing suppliers to the tune of $2.64 billion. Just under 45% of all deals made so far in 2015 went to consumer-facing companies. This is what we now call Retail Education, which is an education supply-chain outside (and essentially invisible to legacy players) the traditional educational ecosystem. I keep reading about major disruptors to education (which have been written about in a cyclical fashion over decades) but nothing has effectively changed in the traditional education industry in that entire time. Apparently, the pundits expect the disruption to come from the inside. Look how well that worked out with MOOCs. In stark contrast, consumers are bypassing the traditional channels altogether and getting their education content directly from commercial suppliers. This is particularly evident in mobile products for early childhood learning and language learning.

Despite the few high-dollar amounts going to higher ed suppliers, there have been only 51 deals made so far this year for a total of $604.8 million. PreK-12 faired a little better with 124 deals and $861.6 million invested. The “surprise” pattern is the renewed interest in corporate-facing edtech suppliers. There were 143 deals made with corporate-facing suppliers so far in 2015 totaling $1.2 billion, impressive considering the near complete lack of investor interest in corporate-facing companies between 2002 and 2011 (periods of two major recessions with dramatic training budgets cuts that have yet to recover).

gamesandlearning.org: Along the same lines as the target market of these products are there certain types of products that investors are flocking to back or have we seen fairly similar increases across the board?

Sam Adkins: In terms of product type, there has been $2.5 billion invested in Self-paced eLearning companies – nearly half of all investments so far this year. That said, most of it was obtained by companies outside the U.S. and heavily concentrated in China. The next highest was Digital Reference-ware at $1.0 billion and Mobile Learning at $822 million with the vast majority going to Asian companies.

What about ‘Merica?

gamesandlearning.org: China and the drop-off in Brazil get special mention in your press release, but how do things look in the U.S. compared to past years?

Sam Adkins: Investment in the U.S. has only apparently diminished over the years, but only in comparison to international activity. Prior to 2010-2011, learning technology investment was almost entirely concentrated in the US. This has changed dramatically. The investment patters in terms of deal flow have remained consistent, but the total dollar amounts pale in comparison to China.

The declining revenues for Self-paced eLearning in the U.S. is an inhibitor going forward for that type of company. On the other hand, investors are now very interested in U.S. Cognitive Learning suppliers and Mobile Learning edugame developers targeting early childhood learning.

Cognitive Learning suppliers garnered $285 million in 2015 so far, the highest in the history of the learning technology industry. 35 Cognitive Learning companies obtained funding in 2015, compared to eight last year and only three in 2013. A Cognitive Learning company called Virgin Pulse obtained $92 million in May 2015, the highest single investment ever made to this type of company. The interesting thing is that, with minor exceptions, most of them are based in the US. So this seems to be a pattern unique to the U.S. so far. The latest Cognitive Learning products on the market are sophisticated behavior modification platforms. The literal definition of learning is behavior modification; the terms are synonymous.

Best-of-breed Game-based Learning suppliers garnered $126.8 million so far this year with 31 deals made, also a record in the industry. There was only $35.9 million invested in eleven Game-based Learning companies last year. 90% of the Game-based Learning suppliers funded so far this year are based in the U.S.

The eLearning Slowdown

Adkins also highlighted another recent Ambient Insight report that noted that while the American self-paced elearning business remained the largest in the world, it has also slipped into negative growth for the first time in history.

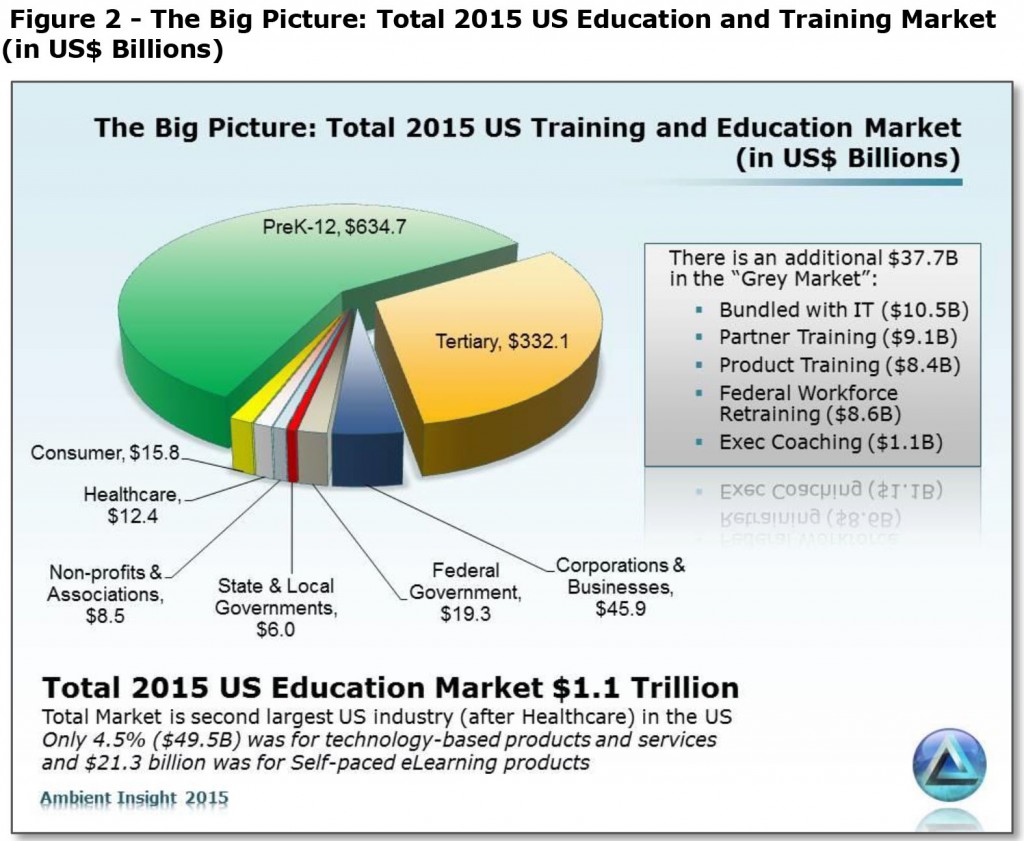

These products are digital tools that are built for instruction and adapt to a learner’s understanding of the subject. In their new report, “The 2015-2020 U.S. eLearning Market,” Ambient Insight notes, “”The growth rate for Self-paced eLearning in the United States (US) is now negative at -2.7%; this is the first time in the history of the U.S. eLearning industry that growth has entered negative territory. Revenues in the U.S. will drop from the $21.3 reached in 2015 to $18.6 billion by 2020. While the growth rate may seem low compared to the other countries, the revenues in the U.S. are the highest in the world… The growth rates in all six of the buying segments in the U.S. are now negative-to-flat, with different factors impacting specific segments. The U.S. eLearning market has entered a new phase characterized by commoditization and product substitution. The irony of a commoditized market is that large volumes of product are sold, but the prices are falling. Commoditization is also characterized by the lack of differentiation in products.”

Adkins noted, “There are bright spots at least for suppliers. The irony is that these ‘bright spots’ are contributing to lower expenditures. 2U garnered $95.8 million leading up to their IPO this year. Instructure obtained $90 million in funding prior to their 2015 IPO.”