From assessment tools to app developers, venture capitalists continued to send more money into education technology and gaming in 2013 according to analysts.

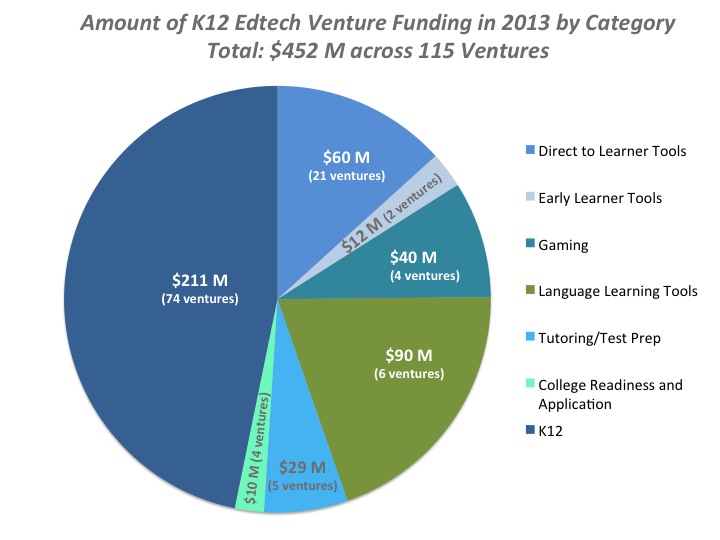

New School Venture Fund reports that funding for edtech, which is broader than just learning games, was up 6 percent in 2013 to $452 million.

The major beneficiaries of that money were companies building teacher-facing tools, language learning products and consumer education products.

About $40 million of the money they tracked went into purely gaming products. According to Jennifer Carolan, Managing Director of NewSchool Seed Fund, venture capitalists are more willing to gamble on consumer learning products than things that aim for the classroom.

“In general, venture capital will take greater risk on consumer looking education products, especially those with compelling user engagement and growth,” she wrote recently on their blog. “Fewer education enterprise products break-through with proven business models and traction, but when they do, scale-up or growth capital is available.”

That interest in consumer learning echoes reporting earlier this year that it is the consumer educational game market that will likely boom in the coming years. In October, Ambient Insight reported that consumer market for learning games is governed by certain critical rules – the rules of what parents want for their children.

“The things that you are interested in are the things that you buy,” Ambient Insight CEO Tyson Greer said of the consumer market. “The things that you want your children to learn are the things that you value.”

In addition to this interest in consumer, especially pre-K, learning games, Ambient Insight also stressed that mobile gaming attracted more support in 2012 and early 2013.

Back at NewSchool, Shauntel Poulson said that she has begun to see a pattern among different types of funders.

“Some have a focus on social impact and/or education and have made several investments (The Trailblazers). Others have shown interest by making a handful of investments and may do more as the industry develops (The Enthusiasts). Several investors may not have a strategic focus on K-12 edtech, but have made a few initial investments (The Dabblers),” she wrote recently, posting an enormously useful list of funders and projects they have supported.

Poulson told gamesandlearning.org that doing your homework before approaching any of these firms is essential.

Some of the firms, she said, may only want to do a single investment in educational technology and if they made their choice hitting them again will almost certainly fail. The more active funders, the ones she calls “Enthusiasts” and “Trailblazers,” may have better luck.

Greer added that gaming firms that take a broader look at where their game could fall – perhaps examining teacher training or assessment – may help answer the funding riddle in 2014.